How Small Business Can Reinvest their Tax Refunds to Drive Results

Huffington Post

U.S. tax laws give small business owners numerous opportunities to earn significant refunds on their taxes. For instance, businesses that record a net loss in one year can carry back that loss against profits in previous years, offsetting their previous profits and earning a refund on those taxes.

This refund can be an important infusion of cash for a small business. For some that are struggling just to get by, it can be the only way the business manages to pay employees and keep the lights on. For others with a little more of a safety net, a big tax refund is a major opportunity. There are numerous beneficial moves a business can make with this cash.

Invest in People

Employees are the most vital resource in any small business. They often have to wear many hats and work extremely hard to keep everything running smoothly. According to ADP, companies that don’t invest in a culture of appreciation can lose up to $2,246 per employee per year. If you find that your employees are overworked or struggling to keep up, you can use your new-found money to help put them in a better situation to succeed.

The most common approach, is to hire new employees. By increasing your headcount, each employee has less overall work and can focus more on their specific role rather than having to multitask and do many different jobs. New employees can be disruptive, though, and there’s always the risk that they don’t work out.

Another strategy to invest in your employees can be to pay for them to undergo training. That can include an internal training program, hiring consultants to do the training, or even paying for them to advance their education on nights and weekends. A strong training and development program helps individual employees live up to their full potential, and boosts long-term productivity.

Outsource Projects

Many small businesses end up doing a lot of ancillary tasks in-house rather than pay someone else to do them. Things like deliveries, customer support, or accounting might be done by employees, even if no one in the company really specializes in these activities. This might save some money, but it creates challenges in the long-term as small businesses might not have the resources to scale these activities and aren’t as well equipped to carry them out as specialized businesses.

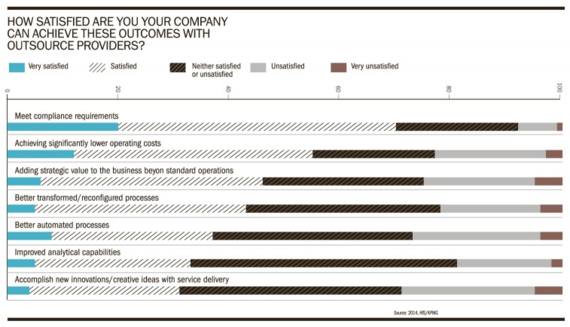

Your tax refund might finally give your business the financial flexibility to be able to outsource these tasks. This can be another way to take the pressure off your own employees, as they no longer have to do these unpleasant tasks and can instead focus on their own work. The cost might be high at first, but ideally it will pay off in increased productivity, and as Raconteur.net describes, there are ways to prove out its ROI.

Upgrade Technology

Upgrade Technology

The number of technology tools for small businesses is astounding. No matter what your business does, there is probably some technology out there that can help you do it better. Any successful small business is probably already utilizing numerous technological aids, but many will be forced to pass up useful tools due to the expense.

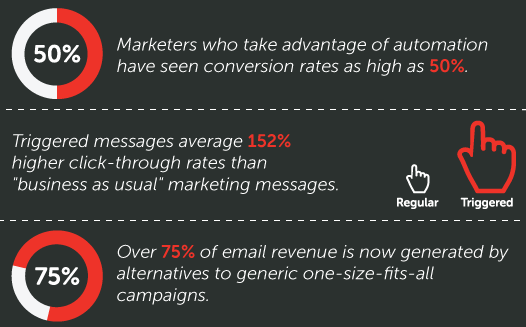

A big tax refund can give you the money you need to finally upgrade some of your business’ technology. An updated customer relationship management (CRM) with built in e-mail marketing, can make it easier for you to attract and retain customers. In fact, marketers using automation tools have seen conversion rates reach upwards of 50 percent according to marketing automation solution provider, Hatchbuck. Back-end accounting and workforce management software can help you spend less time on administrative tasks and get the most out of your employees.

Improve Your Processes

“Process management” is one of those nebulous words that can feel like meaningless corporate-speak at times. In reality, though, your processes are a vital part of your business, and it’s important to make sure they are efficient and easy to understand. A better process can lead to lower costs, better service to customers, and the potential for significant growth.

Changing processes can be a daunting task though. It takes significant time to reformulate the process, and more time to train employees on the new way of doing things. All the while, you have to try to keep everything running smoothly while transitioning from one process to the other.

The excess cash from your refund can help you manage this transition. It can give you the resources to pay employees overtime to work on the new process, or to cover lost revenues if the change impacts business. It can also allow you to hire consultants to analyze your processes for you, as there are many companies out there that offer this service.

Lower Your Future Tax Bill

The government offers tax incentives and rebates to encourage certain types of business spending and investment. For instance, businesses that install solar panelscan deduct 30 percent of the cost from their federal taxes. This deduction can also rollover into future years if the business is not expecting to pay taxes in the current year.

There are dozens of business tax credits available. Some are specialized, such as credits for tech companies engaging in research and development and for companies working low-income communities. Others can be broader. Any small business that starts a pension plan for its employees can get a tax credit for expenses on that plan. Employers that pay for child care for employees can also receive a tax credit.

By making these investments, you accomplish two things. You increase employee morale by offering additional perks, and you reduce your tax bill. That’s a win-win scenario.

Category: Savings and Tools