EMV Chip Technology: What Business Owners Need to Know

Spark Business IQ

If your business accepts magnetic striped payment cards, it’s time for a crash course on the rapidly changing electronic payment technology world.

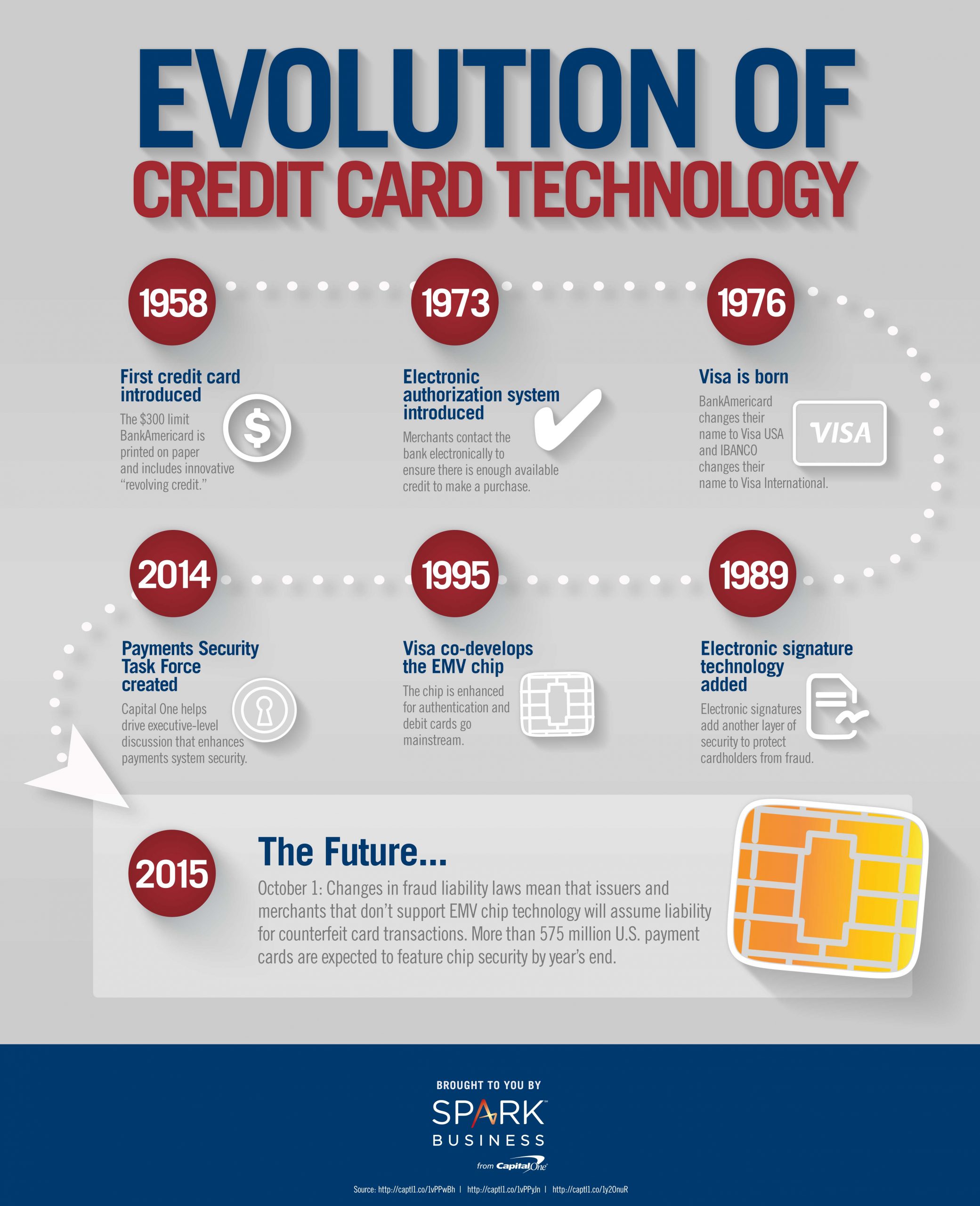

Learning about this technology will help you prepare for pending electronic payment requirement changes, such as Visa’s point of sale (POS) liability shift coming October 1, 2015.

What is an EMV Chip?

EMV (named for Europay, MasterCard, and Visa) refers to a set of standards that enables the acceptance and processing of chip-based payment cards at electronic terminals.

An EMV-enabled payment card contains a microchip with a cryptogram that makes it very difficult for anyone to access, copy, or use the card info except in legitimate card transactions. Because it’s so difficult to copy, fraudsters are deterred from stealing card data and from attempting to use counterfeit cards with merchants. This all adds up to reduced risks associated with card authentication, cardholder verification, and transaction authorization. The bottom line for merchants is reduced risk of fraud and fraud-related chargebacks.

The implementation of EMV chip payment cards is now gaining momentum across the country. First introduced in the mid-nineties, EMV technology has been slow to catch on due mostly to the cost and time involved in implementing it, reports the Washington Post. However, an upcoming liability shift, coupled with an onslaught of widely reported credit card fraud stories is getting business owners’ attention. By the end of 2015, more than 575 million U.S. payment cards will feature EMV chips, according to the Payment Security Taskforce.

How EMV Chip Technology Impacts Small Business Owners

Duplication of EMV chip cards is extremely difficult, according to Visa. This helps reduce fraudulent transactions, financial losses and potential legal headaches for businesses.

As businesses worldwide migrate to EMV chip technology, statistics show it may reduce counterfeit fraud, reports the Smart Card Alliance. In the U.S., many large payment card issuers will migrate to this technology over the next year, says the Alliance.

For example, Visa plans to shift responsibility for counterfeit POS transactions when a chip card is present to the party that prevents a chip transaction from occuring. So if your business is involved in a Visa credit card transaction but you don’t have the equipment and software to process it as an EMV chip transaction, your business may be held liable if the transaction proves fraudulent.

Why Consumers Like It

Today’s customers want convenient, safe payment methods. EMV chip technology meets that demand. Enhanced security features provide peace of mind while reducing fraud resulting from stolen account data or from counterfeit payment cards. Overall, it’s simple, fast and more secure.

Category: Savings and Tools